How Generative AI Development Services Can Drive Innovation in the Financial Sector

Discover how generative AI development services can transform the financial sector, driving innovation and enhancing efficiency in your business operations.

The financial sector is evolving rapidly, driven by technological advancements, evolving customer expectations, and increasing regulatory pressures. Generative AI development services are at the forefront of this transformation, enabling financial institutions to innovate their products, services, and internal processes. From improving financial decision-making to enhancing fraud detection, Generative AI is revolutionizing the way financial services are delivered.

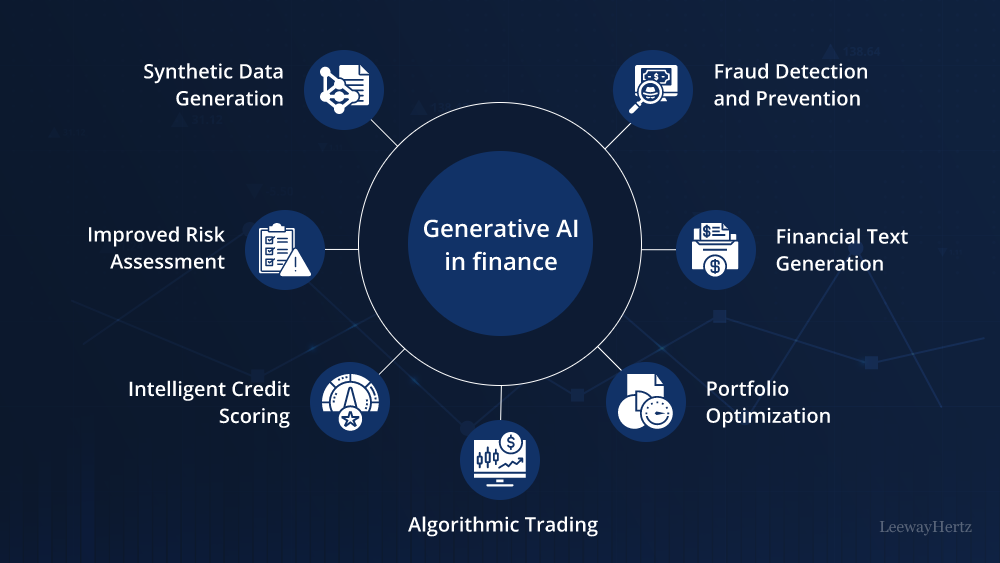

In this blog, we’ll explore how Generative AI development services are shaping the future of finance. We'll look at key applications in the financial industry, including AI for financial services, fintech automation, and AI-based fraud detection, and discuss how this technology is fostering innovation in financial products and services.

What is Generative AI and How Does It Impact the Financial Sector?

Generative AI refers to artificial intelligence models capable of generating new content or data based on input they have learned. These models can create novel solutions, data, or predictions, making them incredibly useful in fields that require analyzing large amounts of information and making decisions based on that data. In finance, Generative AI is used for tasks like predicting market trends, enhancing financial decision-making, creating personalized customer experiences, and detecting fraud.

By leveraging AI-powered finance solutions, banks and financial institutions are able to automate complex tasks, improve accuracy, and offer tailored services to clients. This innovation not only improves operational efficiency but also helps institutions stay ahead of the competition in an increasingly crowded market.

Key Applications of Generative AI in the Financial Industry

1. AI for Financial Data Analysis

In the financial sector, data is a powerful tool, but analyzing vast amounts of financial data manually can be overwhelming. Generative AI for financial data analysis enables financial institutions to quickly process and analyze large datasets to make data-driven decisions.

For example, AI-powered financial tools can analyze market trends, customer behavior, and historical data to predict stock prices, identify investment opportunities, or suggest portfolio adjustments. Generative AI development services help automate these tasks, improving both the speed and accuracy of financial decision-making.

Real-world Example: Goldman Sachs has adopted AI to analyze financial market data, helping its traders and investors make better-informed decisions. AI algorithms identify patterns and trends, providing recommendations on stock trades, which has led to better performance in the financial markets.

2. AI-Based Fraud Detection

One of the most important applications of Generative AI in finance is its role in fraud detection. AI-based fraud detection systems use machine learning algorithms to recognize unusual patterns in financial transactions. By analyzing historical transaction data, these systems can flag suspicious activity in real time, preventing fraud before it occurs.

Generative AI development services can enable financial institutions to continuously improve fraud detection models, as AI systems learn and adapt over time. This makes it possible to detect sophisticated fraud tactics that may otherwise go unnoticed by traditional systems.

Real-world Example: PayPal uses Generative AI to detect fraudulent transactions. The system analyzes transaction data, identifying potential fraud by recognizing patterns that deviate from normal activity. This AI-driven approach has significantly reduced PayPal’s fraud rates while improving transaction security.

3. Generative AI for Financial Product Personalization

Personalization is becoming a key differentiator in the financial industry. Customers today expect financial services tailored to their specific needs and preferences. Generative AI for banks can help institutions develop personalized products and services that meet these expectations.

By analyzing customer data, such as spending habits, financial goals, and risk tolerance, AI-powered finance solutions can suggest personalized financial products, such as investment opportunities, insurance plans, or loan offers. This personalization helps improve customer satisfaction and strengthens the relationship between clients and financial institutions.

Real-world Example: Bank of America utilizes Generative AI in its Erica virtual assistant, which provides customers with personalized financial advice and recommendations based on their spending patterns, financial goals, and personal preferences.

4. Fintech Automation

The rise of fintech has created numerous opportunities for automation in finance. Generative AI is enabling fintech automation by automating complex back-office operations, including data entry, customer onboarding, and loan approvals. This not only reduces operational costs but also enhances efficiency and accuracy.

For example, Generative AI tools can automatically process loan applications, verify customer information, and assess credit risk, streamlining the entire lending process. This accelerates decision-making, reduces human error, and helps financial institutions respond to customer needs faster.

Real-world Example: LenddoEFL, a fintech company, uses Generative AI to automate credit scoring by analyzing non-traditional data sources, such as social media activity and mobile phone usage. This AI-powered process enables quicker and more accurate credit assessments, especially for individuals with limited credit history.

5. Enhancing Customer Support with AI Chatbots

Customer support is another area where AI chatbots are making a significant impact in the financial sector. AI chatbot development services are helping financial institutions create virtual assistants that can handle a wide range of customer queries, from checking account balances to providing investment advice.

AI-powered voice interfaces and chatbots can provide immediate responses to customer inquiries, reducing the wait time and improving user satisfaction. These AI systems also continuously improve by learning from interactions, becoming more effective at addressing customer concerns.

Real-world Example: HSBC has integrated AI chatbots into its customer service operations, allowing customers to receive instant answers to queries about account details, transactions, and financial products. The bank's AI chatbots help alleviate the workload on human agents, ensuring faster response times.

The Benefits of Investing in Generative AI for Financial Innovation

1. Improved Efficiency and Cost Reduction

The automation of tasks such as financial analysis, fraud detection, and customer support through Generative AI significantly reduces the workload for human employees, allowing financial institutions to focus on more complex tasks. By integrating AI-powered solutions into their operations, banks and other financial institutions can improve efficiency while reducing operational costs.

For example, AI-powered fraud detection systems can automatically flag fraudulent transactions without requiring manual intervention, allowing fraud detection teams to focus on investigating flagged activities rather than scanning every transaction manually.

2. Enhanced Personalization

As customers increasingly demand personalized financial services, Generative AI enables financial institutions to meet these expectations. By analyzing a customer’s financial data, preferences, and goals, AI can recommend personalized products and services that are more likely to resonate with the individual.

For instance, AI chatbots can provide customized financial advice, helping customers make informed decisions about investments, loans, and other financial products. Personalization also extends to marketing strategies, where Generative AI can automate the creation of targeted campaigns that are relevant to specific customer segments.

3. Better Risk Management and Decision-Making

Generative AI helps financial institutions manage risk more effectively by providing real-time data analysis and predictive insights. Financial data analysis with AI can identify potential risks before they become problems, enabling businesses to make more informed decisions.

For instance, AI for financial services can analyze market trends, economic conditions, and individual asset performance to assess investment risks, enabling better-informed decisions for portfolio management.

4. Scalability and Future-Proofing

As the financial sector becomes more competitive, Generative AI development services allow institutions to scale their operations and innovate more quickly. AI tools can handle large volumes of data and automate complex processes, which helps businesses keep up with growing customer demands and industry changes.

Moreover, AI-based financial tools are continually evolving, ensuring that financial institutions remain at the cutting edge of innovation. By adopting Generative AI, companies can future-proof their services, offering more sophisticated products that meet the needs of tomorrow’s financial consumers.

How to Get Started with Generative AI in Finance

1. Identify Key Use Cases for AI Integration

Before implementing Generative AI solutions, businesses should assess which areas of their operations could benefit the most from AI integration. Are you looking to improve fraud detection, enhance customer service, or automate data analysis? Defining clear objectives will help determine the best AI tools for your needs.

2. Partner with a Trusted Generative AI Development Company

To successfully implement Generative AI for banks or other financial institutions, it’s crucial to partner with a reliable Generative AI development company. These companies have the expertise needed to design and develop custom AI solutions that align with your specific business requirements.

3. Start Small and Scale

Begin by integrating AI into one or two key areas, such as customer service or fraud detection. As you gain insights and see positive results, gradually scale AI-driven solutions across your operations.

4. Monitor and Optimize AI Tools

Once you’ve implemented Generative AI tools, continuously monitor their performance and optimize them based on user feedback and operational needs. As the AI learns from interactions, it will become more effective and efficient over time.

User Experience with Generative AI in Finance

A leading investment bank partnered with a Generative AI development company to automate risk assessments and financial forecasting. As a result, they achieved a 30% improvement in forecasting accuracy, allowing for more strategic investments and better risk mitigation.

Conclusion: The Future of Financial Innovation with Generative AI

Generative AI development and software development services are driving a wave of innovation in the financial industry. By leveraging AI-powered finance solutions, financial institutions can streamline operations, enhance customer experiences, and stay ahead of the competition. From automating financial analysis to improving fraud detection and personalizing financial products, Generative AI is revolutionizing the way financial services are delivered.

As AI continues to evolve, the future of finance looks promising, with AI for financial services offering more efficient, scalable, and personalized solutions. Now is the time for businesses in the financial sector to explore Generative AI solutions and unlock new opportunities for growth and innovation.

Frequently Asked Questions (FAQs)

Q: How can generative AI development services be used to innovate financial products and services?

Generative AI can be used to create personalized financial products, analyze market trends, and automate risk assessment, leading to more tailored offerings and improved customer satisfaction.

Q: What are the key applications of generative AI in the finance industry?

Key applications include AI-based fraud detection, financial data analysis with AI, fintech automation, and personalized customer experiences through AI-powered tools like chatbots.

Q: Can generative AI development services improve financial decision-making and analysis?

Yes, Generative AI enhances decision-making by providing real-time insights, analyzing large datasets, and identifying patterns that inform investment strategies and risk management.

What's Your Reaction?